What is the "Revised Electronic Book Preservation Law" before its enforcement? 3 + α points

Point 2: Make it possible to "ensure the authenticity" of data

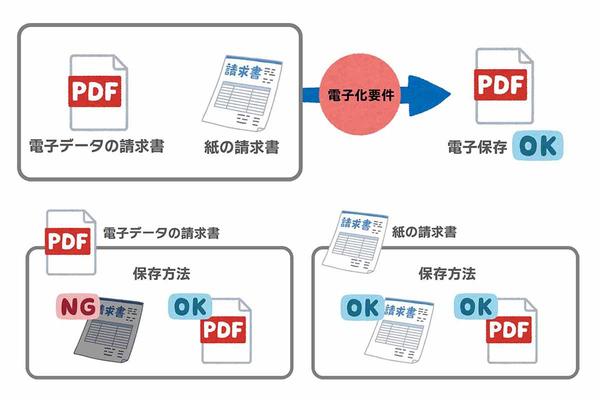

As mentioned in "Point 1", although it has become easier to digitize than before, it is unconditional However, it does not mean that you can save the received file as it is. Whether the original is electronic or paper, there are two main requirements when storing them as electronic data.

One of the requirements is "ensuring authenticity".

In other words, as it may be confusing, ``we know when the file was delivered, and it hasn't been changed later (even if we change it, we know that)'', i.e. ``uniqueness''. Make sure you can guarantee it.”

So, how can we ensure the authenticity? There are several options, but the first method is "the side that issues the invoice gives the timestamp" or "the side that receives the invoice gives the timestamp". However, it seems better not to consider this as an option from the beginning for small and medium-sized companies and freelancers, regardless of large companies.

Biller gives timestamp or bill receiver gives timestampBecause this "timestamp" does not just refer to the file date, it is recognized by the IRS This is because it uses a third-party timestamp service to credibly attach files.

Currently, some companies are providing timestamp services, but the usage fee is expected to cost tens of thousands to hundreds of thousands of yen per service, which is not realistic for many businesses. (It is also possible to develop a system that gives time stamps on your own, but it seems even more unrealistic.)

If the business partner uses those time stamp services and receives the electronic data, only that part can meet the requirements. However, invoices from other business partners must instead be time-stamped by themselves, and it is also necessary to develop administrative procedures from the time electronic data is received until it is given. An increase in labor and cost is unavoidable.

So you usually end up doing something else.

So the second method is to ``establish administrative rules for preventing data correction and deletion''. When we receive invoices and other data as data, what kind of in-house flow will it be used for? It means that such a series of processing is properly organized in documents as internal regulations.

The National Tax Agency prepares a template for this "Administrative Rules", but there is no particular format. It should be created in a format that is easy for the company to use, and it should be made into a material that employees can refer to for correct processing while comparing it with the current internal work.

Establish and operate in-house administrative rules. It is OK to use samples published by the National Tax Agency as a baseReference materials (samples of various regulations, etc.)|National Tax Agency

Even in the sense of eliminating the ambiguity of existing work and reorganizing it, there is no loss in creating administrative rules. However, in the case of small businesses with one to several employees or freelancers, it is true that it is not rational to develop internal regulations one by one.

As a third method, such businesses will choose to use a system that retains records when data is corrected or deleted, or a system that cannot be corrected or deleted.

If you use Sansan's "Bill One", etc., which is compatible with the revised electronic book storage law, it will be quickautomatically enable By doing so, there are further merits depending on the system used. In some cases, the other requirement described later, "ensuring visibility," can also be met at the same time. One such system includes Sansan's "Bill One," which we cooperated with this time.