In the second half of 2018, memory prices remain high, but SSDs are a “buy”

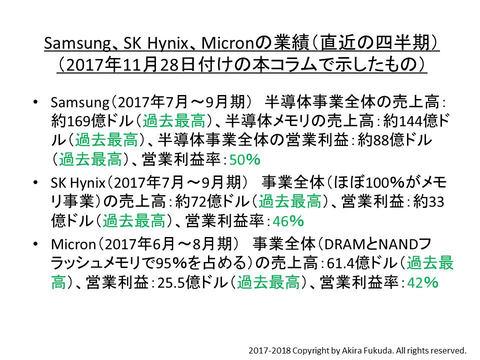

The three major DRAM manufacturers, namely Samsung Electronics, SK Hynix, and Micron Technology, have continued to record record high performance (quarterly basis) since last year (2017). As reported in this column in November last year (memory companies enjoying unprecedented profits due to rising DRAM prices), these three major DRAM companies have achieved record sales and operating profits on a quarterly basis since the beginning of last year. Now updates the amount. The momentum has not stopped even this year (2018).

All three major DRAM companies also deal with NAND flash memory. Since the prices of both DRAM and NAND flash memory rose last year, the business recovered from the memory recession in the first half of the year before last (2016), and the momentum brought unprecedented profits.

This year, as expected, the abnormal momentum of last year seems to have calmed down a bit. Memory demand growth slowed in the first quarter of this year compared to the previous quarter due in part to seasonal factors. In addition, the supply and demand balance for NAND flash memory is easing, and prices are dropping. Although DRAM prices are still rising, they are not as strong as they were in the first half of last year.

Even so, I can't help but sigh at the fact that quarterly sales, operating profit, and operating profit margin all hit record highs in the most recent quarters, or are at levels close to record highs.

Let's do a quick comparison of each company's most recent quarterly results with the quarterly results that this column reported last November.

Samsung Electronics, SK Hynix, Micron Technology's performance ( most recent quarter). Compiled by the author based on the published materials of each company A record high of $20.2 billion. Last November's report (hereinafter referred to as "previous report") introduced the financial results for the third quarter of 2017 (July-September 2017), and semiconductor sales reached a record high at this time as well. was The amount is approximately $16.9 billion. Samsung's semiconductor business operating profit and semiconductor memory sales also hit record highs in the second quarter of 2018 (April-June 2018).SK Hynix announced that its overall sales for the second quarter of 2018 (April-June 2018) (DRAM and NAND flash memory accounts for nearly 100%) were about $9.5 billion, which is also the past. repainted the best. In the previous report, we introduced the results for the third quarter of 2017 (July to September 2017), and sales reached a record high at this time as well. The amount is approximately $7.2 billion. SK Hynix's operating profit also hit a record high in the second quarter of 2018 (April-June 2018).

Micron Technology (hereafter referred to as "Micron") announced the fourth quarter (June-August 2018) sales (DRAM and NAND flash memory accounts for about 96%) At $8.44 billion, the company also posted record sales. In the previous report, we introduced the financial results for the fourth quarter of the fiscal year 2017 (June-August 2017), and at this time as well, we achieved record-high sales. The amount is $6.14 billion.

The market share of DRAM sales by amount is Samsung at the top, SK Hynix at 2nd, and Micron at 3rd (according to research company DRAMeXchange). These three companies account for about 95% of the entire DRAM market. The rest are very small DRAM vendors such as Taiwan and the United States. From here on, let's take a look at the latest business performance of each company, DRAM market trends, and NAND flash memory market trends from the top three published materials.